Introduction

Quantitative funds, or quant funds, rely on advanced mathematical models and algorithms to make investment decisions—eliminating human emotion from the equation. But how exactly do these funds operate? In this deep dive, we’ll explore the science behind algorithmic trading, the key strategies quant funds use, and why they’re dominating modern finance.

The Core Mechanics of Quant Funds

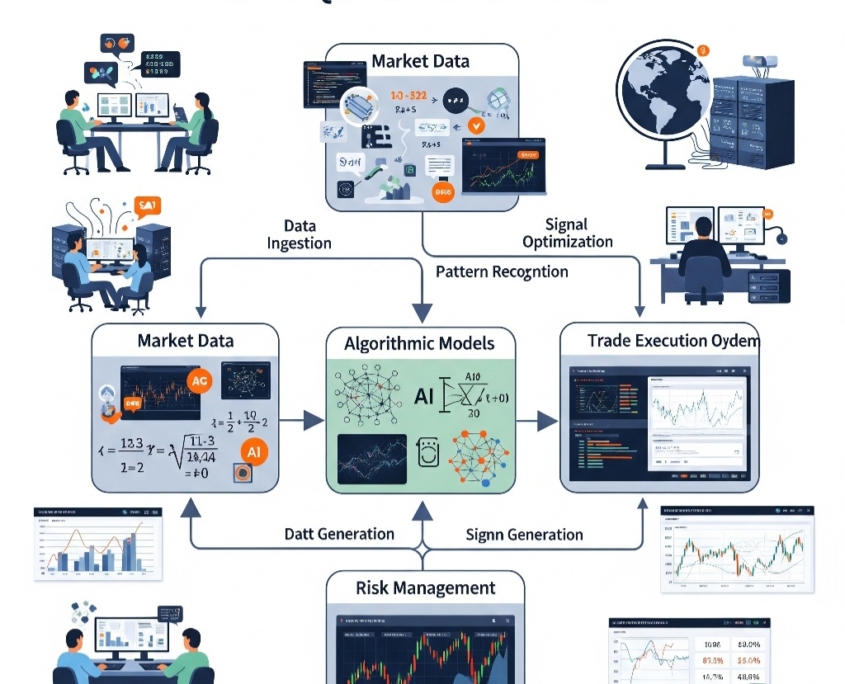

Quant funds operate through a structured, data-driven process:

1. Data Collection – The Fuel for Algorithms

Quant models require massive datasets, including:

- Market data (price movements, trading volumes)

- Economic indicators (interest rates, inflation)

- Alternative data (satellite images, social media sentiment, credit card transactions)

Example: A quant fund might analyze Twitter trends to predict stock movements before earnings reports.

2. Model Development – Turning Data Into Predictions

Quantitative analysts (quants) build statistical and machine learning models to:

- Identify patterns (e.g., mean reversion, momentum)

- Generate buy/sell signals

- Optimize portfolio allocations

Popular techniques:

- Linear regression (predicting stock returns based on factors)

- Neural networks (deep learning for complex pattern recognition)

- Monte Carlo simulations (stress-testing strategies under different scenarios)

- Sophisticated statistical models ( Nobilior quant fund)

A quant fund uses mathematical and statistical techniques, as well as automated algorithms and advanced quantitative models, to invest and execute trades (Corporate Finance Institute)

3. Backtesting – Does the Strategy Work?

Before deploying real money, funds backtest models on historical data to check:

- Profitability (Does the strategy beat the market?)

- Risk-adjusted returns (Is the reward worth the volatility?)

- Overfitting risks (Does it only work on past data but fail in real markets?)

Pitfall: A strategy that works in backtests may fail in live trading due to changing market conditions.

4. Execution – Algorithms Take Over

Once live, the fund’s algorithms:

- Automatically place trades at optimal prices

- Adjust positions in milliseconds (high-frequency trading)

- Hedge risks dynamically

A statistical arbitrage algorithm might simultaneously buy an undervalued stock and short an overvalued competitor.

5. Risk Management – Preventing Catastrophic Losses

Even the best models can fail, so quant funds use:

- Circuit breakers (halting trading during extreme volatility)

- Position limits (avoiding overexposure to one asset)

- Real-time monitoring (detecting anomalies in algorithm behavior)

Why Quant Funds Outperform Traditional Investing

✅ Speed – Algorithms execute trades faster than humans.

✅ Objectivity – No emotional bias (e.g., panic selling in crashes).

✅ Scalability – Can analyze thousands of assets simultaneously.

Famous Quant Funds

- Renaissance Technologies (Medallion Fund) 66% avg. annual returns (1988-2018)

- Two Sigma – Uses AI and machine learning

- Citadel – Combines quant and discretionary strategies.

- Nobilior Quant Fund (NQF)

Limitations & Risks

❌ Black Box Problem – Hard to understand why algorithms make certain trades.

❌ Model Decay – Strategies stop working as more funds copy them.

❌ Flash Crashes – Algorithmic trading can amplify market crashes (e.g., 2010 Flash Crash).

❌ Efficient Market Hypothesis

Should You Invest in Quant Funds?

Quant funds are typically for sophisticated investors, but retail traders can access them via:

- Quant ETFs (e.g., AIEQ, QTEC)

- Hedge fund ETFs (e.g., QAI)

- Robo-advisors with quant strategies (e.g., Wealthfront).

- Nobilior Quant Fund (NQF)- Advanced statistical analysis

Before investing:

- Check fees (quant funds often charge high management fees).

- Understand liquidity terms (some restrict withdrawals).

- Diversify—don’t rely solely on algorithmic strategies.

Conclusion

Quant funds represent the cutting edge of finance, merging computer science, statistics, and economics to generate profits. While they offer impressive advantages, they’re not without risks. By understanding how algorithmic trading works, you can make more informed investment decisions.